Comparison of preferred saving tools used by corner shops across different countries in Africa – Mali, Nigeria, Senegal, Uganda, and Zimbabwe

| In this blog, we will explore the types of savings tools that corner shops choose to utilize over others in the respective countries where we are collecting data in Africa. This blog does not include an analysis of the size of the savings deposited or balance maintained, or frequency of transactions. In future blogs, we will examine these trends in relation to particular savings tools. |

The Corner shop diaries project utilizes the financial diaries methodology to collect data from 95 small neighborhood corner shops across Mali, Nigeria, Senegal, Uganda, and Zimbabwe. The data helps us to analyze the functioning of small businesses, especially during the times of the Covid-19 pandemic. In this article, we will focus on the different saving tools that each of these businesses are choosing to use compared to others. Saving tools used across our sample likely depend on a variety of factors such as availability and access to specific tools, ease of using specific tools, trust in certain tools, specific country economic regulations, and sometimes lack of an informed decision on where to save money safely and with profit.

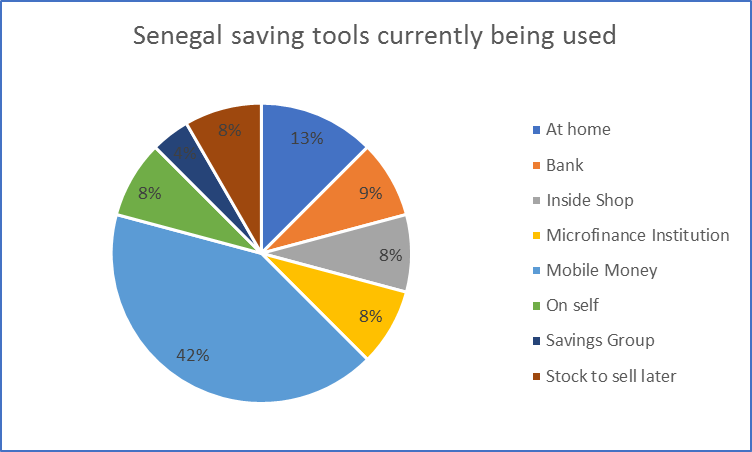

Our data in Senegal reflects a diverse saving field. There are many options available and these are being well used. Mobile money is the most popular representing 42 percent of the savings tools used by the respondents followed by informal individual forms (keeping money at home (13 percent) and keeping money on self (8 percent)). The option of ‘inside shop’ was where 8 percent of the savings were kept. Formal banking (microfinance and bank) is well behind mobile money saving (17 percent combined). Other options of savings groups and ‘stocks’ are rare (4 percent and 8 percent respectively). When we consider mobile money as a formal savings form, more than half of the shops’ combined savings tools (59 percent) are in a formal institution (mobile money 42 percent, bank 9 percent, and microfinance 8 percent). The main conclusion is that the Senegalese shops use diverse options of savings tools.

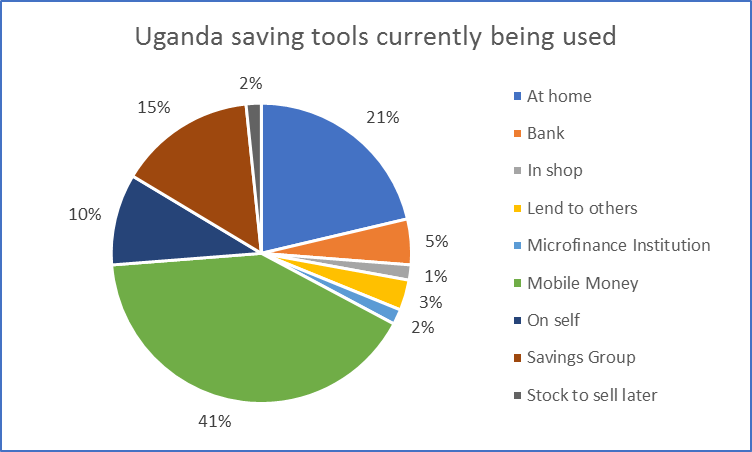

In Uganda, there is also quite a variety of saving tools being used. Here, mobile money also leads as the most preferred saving tool with almost the same proportion as Senegal of all tools used at a 41 percent usage rate followed by Keeping money at home (21 percent) and Savings groups (15 percent). Here, banking hardly features (just 5 percent of the savings). Both Senegal and Uganda cases reflect the growth of mobile money services as saving tools over the past years. It is also worthy to note the widespread use of Saving groups in Uganda which reconfirms L-IFT’s findings in other studies (there, savings groups represented 50 percent of the savings tools used for a general low-income population).

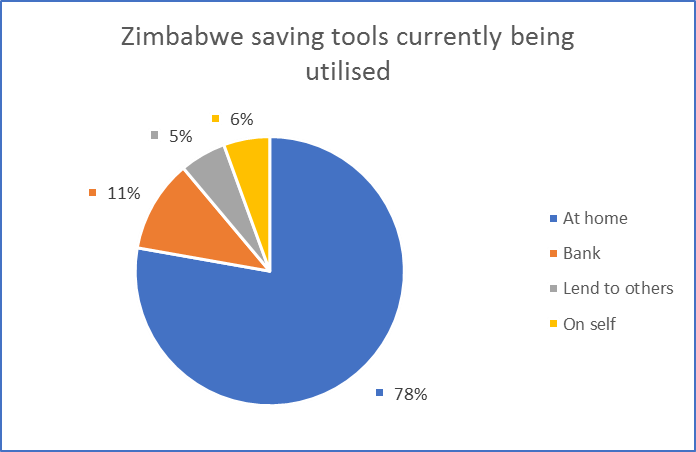

In the Zimbabwe sample, we see a drastic difference as compared to the rest of the countries since in Zimbabwe saving at home is the most preferred saving tool at 78 percent. In addition, 6 percent of the savings are kept as ‘money on themselves’ meaning that a staggering 84 percent of savings tools used by corner shop respondents keep savings completely informally and individually. Only 11 percent of the savings mechanism used are in formal banking. In a country where banking regulations are not stable, it is difficult to trust banks with one’s money. Equally, mobile money is not in use for savings as there are often difficulties in depositing and withdrawing this money if it is in foreign currency. It is important to note that the USD is the preferred currency for trade throughout the country as opposed to the local Zimbabwe dollar. Many small shops reject mobile money or change it into USD as soon as it is received.

In Nigeria where we are currently tracking only 6 corner shops, we see just two types of saving tools being utilized: banks and savings groups. This scenario reflects a difference from all other countries as formal banking is the option most used. However, it is important to note that in Nigeria, many utilize the informal savings groups (Esusu). Even those with formal bank accounts will also have a savings group they are part of. For example, one respondent, who has 4 bank accounts for different saving goals, also has an informal group where they also save some money. Being part of the savings group helps her to save her money quicker than having to go to the bank. The informal savings group is culturally entwined with the people’s lives and offers a community-level savings tool without the need to go to a formal bank.

The findings here reconfirm L-IFT’s financial diaries findings amongst young Nigerians – in that study, Nigeria also had a relatively higher use of formal savings. It is remarkable that in Nigeria the savings mechanisms ‘at home’ and ‘on self’ are completely absent. It may be related to severe security issues in that country. Respondents might not wish to advertise keeping any money in these places.

In Mali, where we are tracking 18 businesses; keeping savings at home, on self, and in savings groups are most popular compared to other savings tools available. In Mali, we also do not see banking being utilized. This is because small corner shops believe that it is difficult to get money when one banks it. They also report that they do not have a lot of money and thus do not need any elaborate money-keeping tools. They also prefer to avoid mobile money because of the fees associated with it. Mali is therefore closest to Zimbabwe in terms of the informality of savings channels.

The analysis of saving tools gives us a glimpse into the different tools available and are being used by small corner shops across different countries. We also see the incredible use of mobile money at the expense of services such as formal banking which is not the favored tool across almost all the countries surveyed, with the notable exception of Nigeria. Savings groups were also common across several countries. They were most prominent in Uganda, Nigeria, and Mali. In Senegal, there was some usage of savings groups, but very minor. Only amongst the Zimbabwe respondents do we see saving groups not appearing at all. Corner shops expect a quick, affordable, easy to set up, and versatile saving service as their businesses operate on a day-to-day basis, often facing unpredictable circumstances.