Part One

What is the RISE project?

The RISE Project is an initiative from Opportunity International together with a number of partners, including OBUL, FINCA International and FINCA Uganda, PHB Development, and L-IFT. RISE stands for Refugees: Innovation, Self-reliance, and Empowerment. It is a project being implemented in Uganda and primarily focuses on refugees from different countries of origin settling in the country. Uganda is currently Africa’s largest refugee-hosting state. The project covers two quite distinct refugee settlements, Kiryandongo and Nakivale.

The main objective of the project is to promote the development of self-reliant, integrated, and financially included refugees and host communities in Uganda. The partners work on three components: study, design, and implementation. The study serves to understand the situation and ambitions of refugees and which financial services they need. It also studies what effects the interventions have on the participants. The design component consists of designing appropriate financial services and relevant financial literacy training. The implementation delivers financial literacy training, relevant accounts, and loans that match refugees’ needs.

The study component of the RISE project

L-IFT is responsible for the study component. It conducts a long-term financial diaries study in both locations which helps the entire project to understand the detailed situation of different groups of refugees as well as learn how the services change participants’ lives. The diaries also serve the partners to start a dialogue with refugees, testing ideas, getting feedback and suggestions on what type of services and interventions to provide and how to offer them.

As a side-effect, refugees who participate in the diaries study also benefit from this process. Some report that it helps them get a grip on their financial situation. It enables them to better manage their financial activities like income, expenses, savings, and loans.

Meaning of Financial Diary and Its Purpose

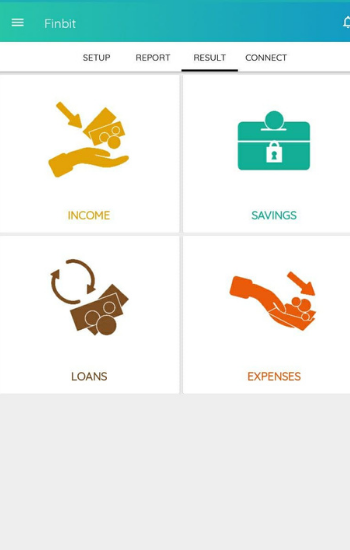

The Financial diary is a type of research conducting data collection within a specified group of people on a repeated basis. In the RISE project, the financial diaries data collection conducts repeatedly on a weekly basis. In our case, the key elements of the financial diaries are income, expense, savings, loans, and working hours. Based on these financial variables, our field researchers in both locations on a weekly basis record the financial transaction of the respondents.

The respondents of the RISE project are refugees who came from various countries such as South Sudan (Kiryandongo) and Congo and Burundi (Nakivale). The refugee’s record of their financial activities has a great role in properly managing the money they earn in various ways. A refugee keeps track of his/her daily income, records his/her expenses, records his/her loans, and records his/her savings and the like. In this way, they will be well aware of each and every income source and expenditure. In addition to that, the refugees acquire the understanding, know-how, and knowledge of financial management. On top of that, they will make it a part of their daily routine.

Background about Finbit App and Its Benefit for the RISE Project

The tool that we used to collect financial diaries for RISE was SurveyToGo. With this survey app, L-IFT conducted financial diaries interviews on a bi-weekly basis from August 2019 until February 2021. L-IFT has been using this survey application for numerous diaries projects since 2014. However, simultaneously since July 2018, L-IFT has been developing its own application for the purpose of collecting the financial diaries data, fully tailor-made to the specific requirements of diaries. The application’s name is Finbit. Finbit is a technology system comprising an android app, a data portal, and a range of data analysis processing serving both components. In other words, it’s a financial tracker tool.

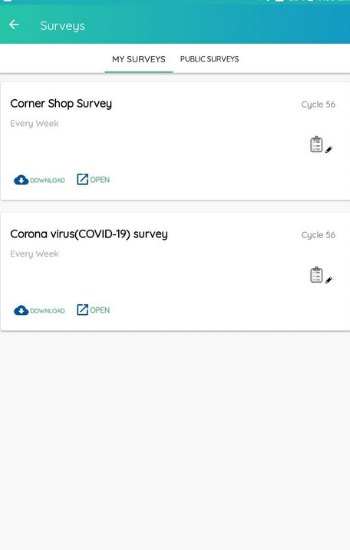

The Finbit app is used for L-IFT projects as a tool for financial diaries data collection and surveys as well. Through the application users easily can record their financial diaries themselves on a daily or regular basis. It is also used as a data collection tool for conducting quantitative studies (interview-based data collection). For example, currently, L-IFT is conducting a survey through the Finbit app on COVID-19 and Corner Shop projects. The Finbit application has been used in RISE project as well, on a trial basis, interviewing more than 100 refugees since August 2019 (so the RISE project had both SurveyToGo respondents and Finbit respondents). Since mid of February 2021, the Finbit application is used as a tool for both those who started with SurveyToGo and those who immediately worked through Finbit.

In the process of switching the data collection tool from SurveyToGo to Finbit, various actions have been taken. They are listed below.

- 1. Providing training for field researchers on how to register and use the app

- 2. Based on the training, field researchers created the respondent and surveyor account

- 3. Then, the field researchers joined and started the Finbit app as respondent and surveyor users.

- 4. Finally, the field researchers started conducting the financial diaries data collection and records from their own respondents.

In the coming blog, we will explain the practical experience of the Finbit Application in the RISE project financial diaries.

By: Aschalew Worku