Part Two

The Finbit Experience as a Tool for the RISE Project

In the previous blog, we have discussed what the RISE project is all about and its purpose in the life of the refugees in Uganda. It also gave a description of the financial diaries and the background of the tool that is used in the process of data collection for the study. This blog will describe how the field researchers have become users of the Finbit app.

Users can find Finbit (‘Finbit by L-IFT) on PlayStore on any android device (mobile phone or tablet). After downloading the app, they start by creating a Finbit account. For this, an email address or telephone number is required. The field researchers then create two accounts: one as a respondent and one as a surveyor. The respondent account anyone can open to record and keep track of their daily financial transactions and activities. (To use the app for data collection through interviews, one needs the surveyor account which is not publicly available.)

The surveyor account is opened for collecting financial diaries from the study participants. To conduct the financial diaries by the Finbit app, each and every respondent should have an account. With the support of our surveyors, all of the study participants created their Finbit accounts. Then, after all the sign-up processes were completed, each study participant got assigned internally to their field researchers to conduct the financial diaries.

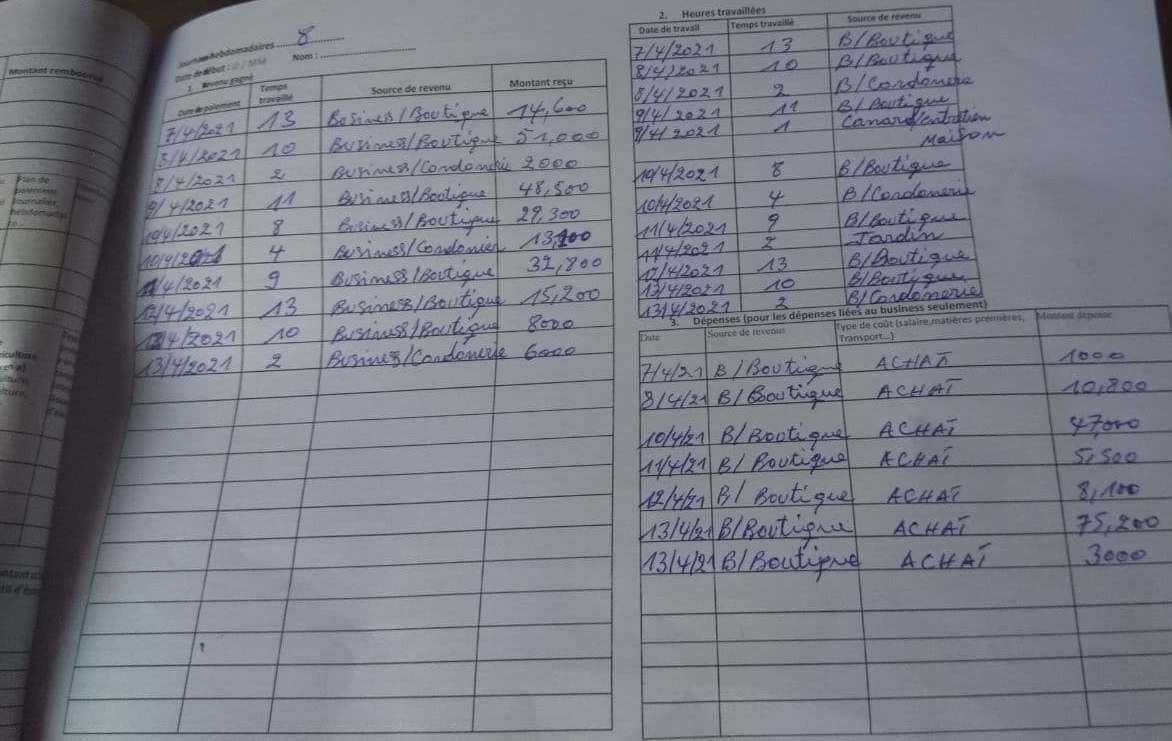

The field researchers conduct the diaries repeatedly with each of their respondents, on a weekly basis. To facilitate and smoothen the data collection process, a booklet has been prepared for study participants to record their financial transactions at home or workplace, which will help the interview to record complete data.

The participants were trained on how to use and record their daily financial transactions in the booklet. Respondents record their daily financial activities according to the training. When the field researchers come to interview, they also review the daily activity of the study participants in the financial booklet, which serves to ensure the data entered in the app is complete. The booklet is just the way to memorize everything but the data is entered based on an interview. The field researcher, by asking the leading and probing questions for respondents, will record the financial transactions into the Finbit app by the type of data.

When we switched the data collection from SurveyToGo and started using the Finbit app, there were challenges. For example, there were challenges in the process of creating respondent and surveyor accounts, in assigning tasks for the surveyors, typo errors in the email account, and forgetting account passwords by surveyors. The team found many ways to address these issues. For instance, with Telegram (a chat app) groups were created to address the challenges instantly, making and sharing helpful videos on how to use the app, and developing manuals for guidance to use the app.

After delivering training for field researchers, which altogether took about a week of training, the Finbit app has been used for collecting the financial diaries for the RISE project. Currently, in the RISE project, 12 field researchers are involved in collecting financial diaries. Of these, eight are from Nakivale and four Kiryandongo locations. These field researchers are collecting data from 179 respondents. Of which, 45 are from Kiryandongo and 134 from Nakivale.

In each weekly round of interviews, the starting day of doing tasks is Monday, and the last day is Friday or Saturday. During these days each field researcher contacts all of his/her respondents and record their daily financial transactions on the Finbit app for the previous seven days.

Nakivale refugee settlement, Uganda.

In this process, we are observing that the study participants are benefiting by recording and managing their income and expenses on a daily basis. For instance, for a question, “How did the use of a financial diary benefit you?” a respondent from the Nakivale location replied;

“It helps me to know my weekly inflows and outflows, it gives me an idea to save as much money as I can for future needs.”

A similar question was posed to another participant and answered;

“These help us to manage our money, to know how much we earned and how much we spent.”

He added,

“It stops me from making a lot of expenditures.”

Looking at the overall response, the study shows that the respondents themselves think that keeping a record of their daily income and expenses helps them to maintain healthy financial management. Whether this is leading to changes in behavior or better financial results, would need further research. There is a project in the pipeline that will study the effects of people themselves filling their Finbit reports.

I hope you enjoyed this blog.

In the next blog, I will show what the quantitative Finbit data shows. Stay tuned.

By: Aschalew Worku