In the last article (https://l-ift.com/lives-vs-livelihood-refugees-in-uganda-part-1/), we presented findings on the implications of the lock-down on employment of the refugees in Uganda. In this article, we will discuss the effects of the lock-down on business.

In the RISE diaries study in Nakivale and Kiryandongo refugee settlements, according to the baseline, 52 percent had some form of income generation or (small) business. Business activities include retail sales (meaning selling directly to consumers); trade (meaning selling to businesses or organizations); manufacturing (making furniture, baskets, garments production, food processing…); restaurants, bar café, bakery (selling food & drinks to people); service business (hairdresser, (motor-) bike repair, tailoring, repairing items…); agent work (selling airtime, mobile money,…) and renting (rooms, vehicle, equipment…). Out of the listed business types, the most common one the respondents have is “retail sales” (55 percent).

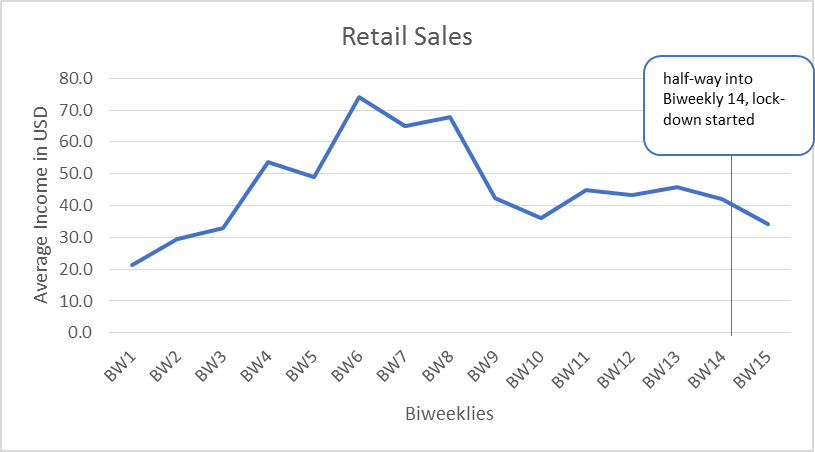

As indicated earlier, every biweekly, the respondents are asked the amount of income they earned in business in the previous two weeks. The following graph shows the average income earned from retail sales over the biweeklies. As can be seen, it is relatively about the same level even after the lock-down most probably due to essential shopping being still allowed.

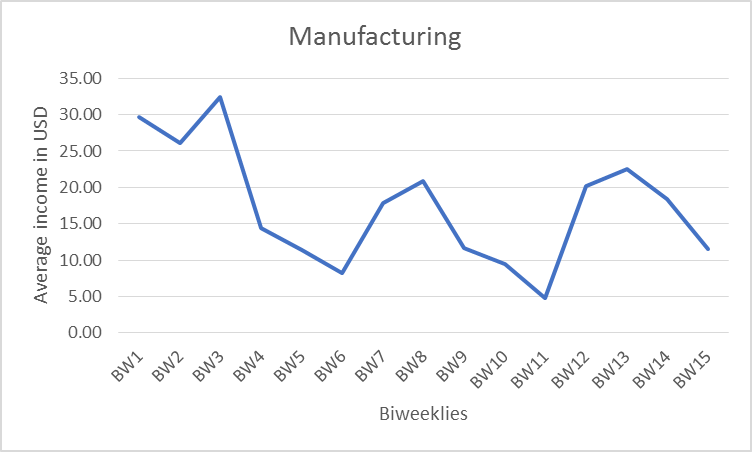

Average income from the manufacturing business had decreased by about 50% since biweekly 13, but the income had been fluctuating significantly before.

Trade income has been altogether on and off. It has not picked up due to lock-down and both biweeklies with lock-down displayed no income from trade.

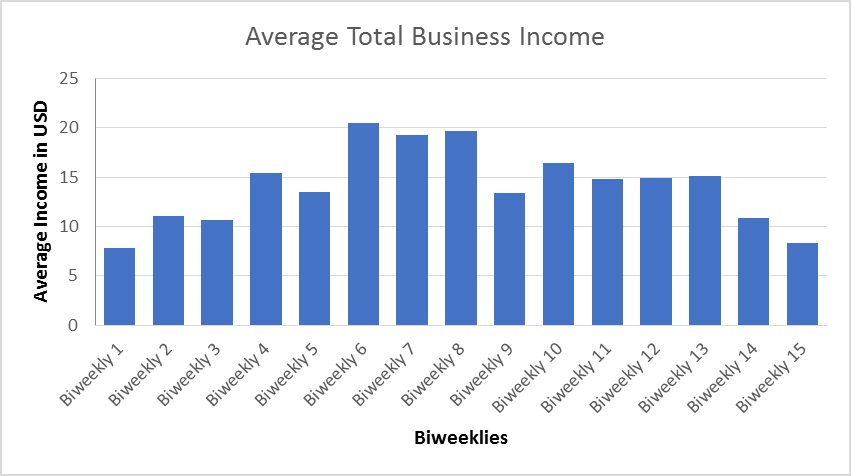

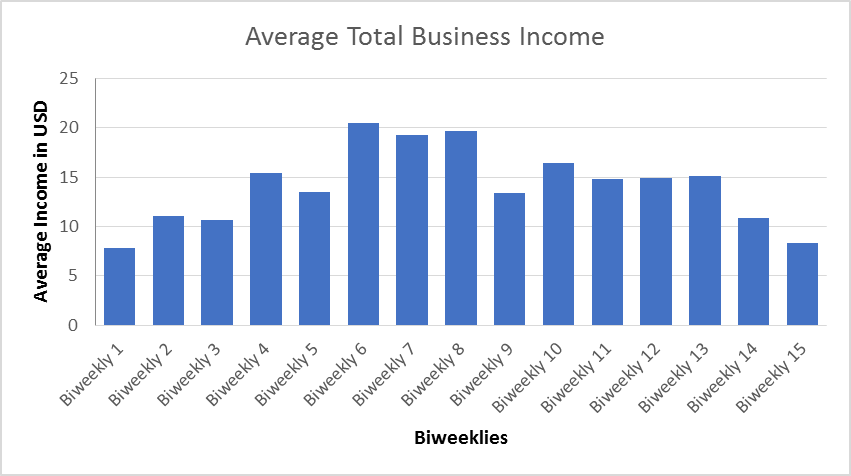

Overall, there is a modest decline in average income from all the business types in the two last interviews, since the lock-down. The decline is probably limited due to the retail business income showing constant values.

We will continuously monitor the respondents’ livelihood status over the coming weeks. In the next article, we will show the impact of the lock-down on agriculture.

By: Mahlet Alemayehu

This blog is written using data from the RISE project, funded by Opportunity International, with consulting services from PHB.

PHB collaborates with international development agencies, banks, regulators and other impact makers around the world to assess, implement and scale digital interventions. We leverage the expertise of our team to support the design of digital finance ecosystems that can strengthen the resilience of communities in need. To learn more about PHB activities, publications and training, visit www.phbdevelopment.com