As mentioned in our previous blogs, some 152 refugees in Uganda answered questions around Covid-19 just before and just after the lockdown was imposed in the country.

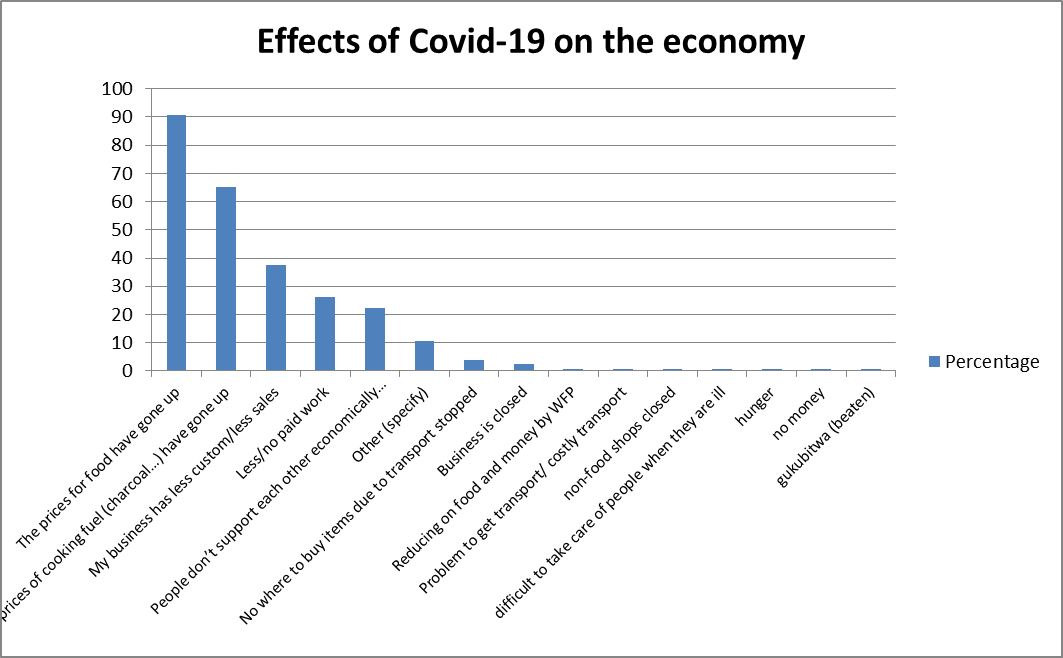

The effects were quite immediate and already took effect before the lockdown. The foremost problem is that food prices went up (91%) and the price of cooking fuel went up (65%). More than one-third of the respondents reported that their business had less custom and sales (38% and less than half the respondents have a business, so practically all businesses were already hit). About a quarter of the respondents mentioned that they had less or no paid work (16%). In addition, quite a number worried that ‘People don’t support each other economically anymore’ (22%).

When we sent out the questions, the lock-down had not been announced and at L-IFT we had not expected the government to take such a measure, considering the fragility of the economy and the limited funds available to feed the people. That’s why we had not asked specific questions on lock-down at that stage.

Several respondents themselves mentioned the economic effect of the lock-down and there were particular reports that transport had disappeared (and had become very costly before the lockdown started). This is affecting the shops. The shops say that demand for the products is still good but they have no possibility to stock their shops.

Since the lock-down started, virtually no transportation was available within as well as to and from Nakivale[1]. Only a rare trader has arrived since the lock-down. Nakivale lies 20 km from a small market town on one of the worst unpaved roads in the country. It takes about 45 minutes to reach. Mbarara town is at 65 km distance.

[1]The other refugee settlement we study is Kiryandongo. However, this is at walking distance from Bweyalu, a small market town on a major road between Kampala and Gulu.

How will such a settlement survive without food coming in?

This blog is written using data from the RISE project, funded by Opportunity International, with consulting services from PHB.

PHB collaborates with international development agencies, banks, regulators, and other impact makers around the world to assess, implement and scale digital interventions. We leverage the expertise of our team to support the design of digital finance ecosystems that can strengthen the resilience of communities in need. To learn more about PHB activities, publications and training, visit www.phbdevelopment.com